These entries are made at the end of an accounting period to adjust accounts and reflect any changes that have occurred during the period. This principle only applies to the accrual basis of accounting, however. If your business uses the cash basis method, there’s no need for adjusting entries. In October, cash is recorded into accounts receivable as cash expected to be received. Then when the client sends payment in December, it’s time to make the adjusting entry.

What is the approximate value of your cash savings and other investments?

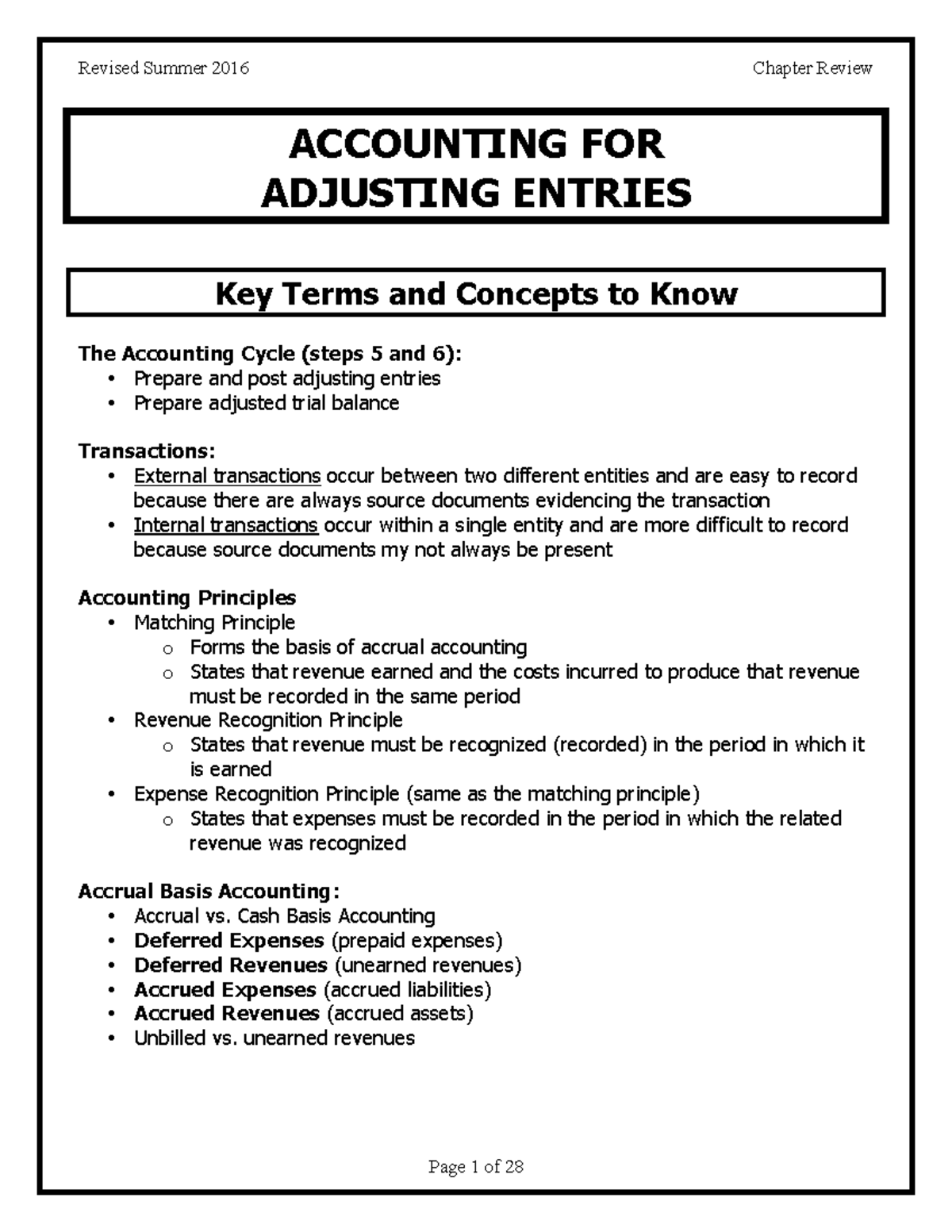

Adjustment entries are made at the end of an accounting period, which can impact the timing of when revenue and expenses are recorded. For example, if an adjustment entry is made to defer revenue to a future accounting period, this will delay the recognition of revenue until the future period. Adjustment entries are an essential aspect of accounting that ensures financial statements are accurate and follow accounting principles.

Deferrals versus Accruals

Similarly, if a company has a liability that has increased in value, an adjustment entry is made to reflect this change. Depreciation expense is the allocation of the cost of a long-term asset over its useful life. To record depreciation expense, an accountant would debit an expense account and credit an accumulated depreciation account. Adjustment entries are an important part of the accounting period and the accounting cycle. The accounting period is the period of time for which financial statements are prepared, usually one year.

Accumulated Depreciation

It is the end of the first month and thecompany needs to record an adjusting entry to recognize theinsurance used during the month. The following entries show theinitial payment for the policy and the subsequent adjusting entryfor one month of insurance usage. The required adjusting entries depend on what the complete guide to franchise tax types oftransactions the company has, but there are some common types ofadjusting entries. Before we look at recording and posting the mostcommon types of adjusting entries, we briefly discuss the varioustypes of adjusting entries. The balance sheet reports information as of a date (a point in time).

The Process of Recording Adjustment Entries

The adjusting entry will debit Interest Expense and credit Interest Payable for the amount of interest from December 1 to December 31. The $500 in Unearned Revenues will be deferred until January through May when it will be moved with a deferral-type adjusting entry from Unearned Revenues to Service Revenues at a rate of $100 per month. The accountant might also say, “We need to defer some of the cost of supplies.” This deferral is necessary because some of the supplies purchased were not used or consumed during the accounting period.

Recall the transactions for Printing Plus discussed in Analyzing and Recording Transactions. Press Post and watch your fixed assets automatically depreciate and adjust on their own. This graded 30-question test provides coaching to guide you to the correct answers. Use our coaching to learn the WHY behind each answer and deepen your understanding of the topic Adjusting Entries. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- The company may also enter into alease agreement that requires several months, or years, of rent inadvance.

- Previously unrecorded service revenue can arise when a companyprovides a service but did not yet bill the client for the work.This means the customer has also not yet paid for services.

- The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized.

- Since a portion of the service wasprovided, a change to unearned revenue should occur.

- At the same time, managing accounting data by hand on spreadsheets is an old way of doing business, and prone to a ton of accounting errors.

The four types of adjustments in accounting include accruals, deferrals, reclassifications, and estimates. Accruals and deferrals involve adjusting entries to record transactions that have occurred but have not yet been recorded. Reclassifications involve moving amounts between accounts, while estimates involve adjusting amounts based on expected future events. Adjustment entries are important accounting tools that help businesses to accurately record their financial transactions and ensure that their financial statements are accurate.

Adjustment entries are usually made in the general journal, which is used to record transactions that do not fit into any of the other journals. Each entry consists of a debit and a credit, and is recorded in accordance with the double-entry accounting system. Manually creating adjusting entries every accounting period can get tedious and time-consuming very fast.

For example, if you have an annual loan interest payment due in February and no liability is reflected on the books in January, you’re going to overestimate your available cash. Likewise, if you make an annual business insurance payment and it’s not adjusted, you may believe your overall cost of doing business has increased when it hasn’t. With an adjusting entry, the amount of change occurring during the period is recorded.